All Categories

Featured

If you're going to make use of a small-cap index like the Russell 2000, you may desire to pause and think about why an excellent index fund business, like Vanguard, doesn't have any funds that follow it. The reason is due to the fact that it's a poor index. And also that changing your entire policy from one index to one more is rarely what I would call "rebalancing - universal life insurance agent." Cash money worth life insurance policy isn't an eye-catching asset course.

I have not also dealt with the straw guy here yet, and that is the reality that it is reasonably rare that you in fact have to pay either taxes or considerable compensations to rebalance anyhow. I never have. The majority of smart financiers rebalance as long as feasible in their tax-protected accounts. If that isn't quite adequate, very early accumulators can rebalance simply making use of brand-new payments.

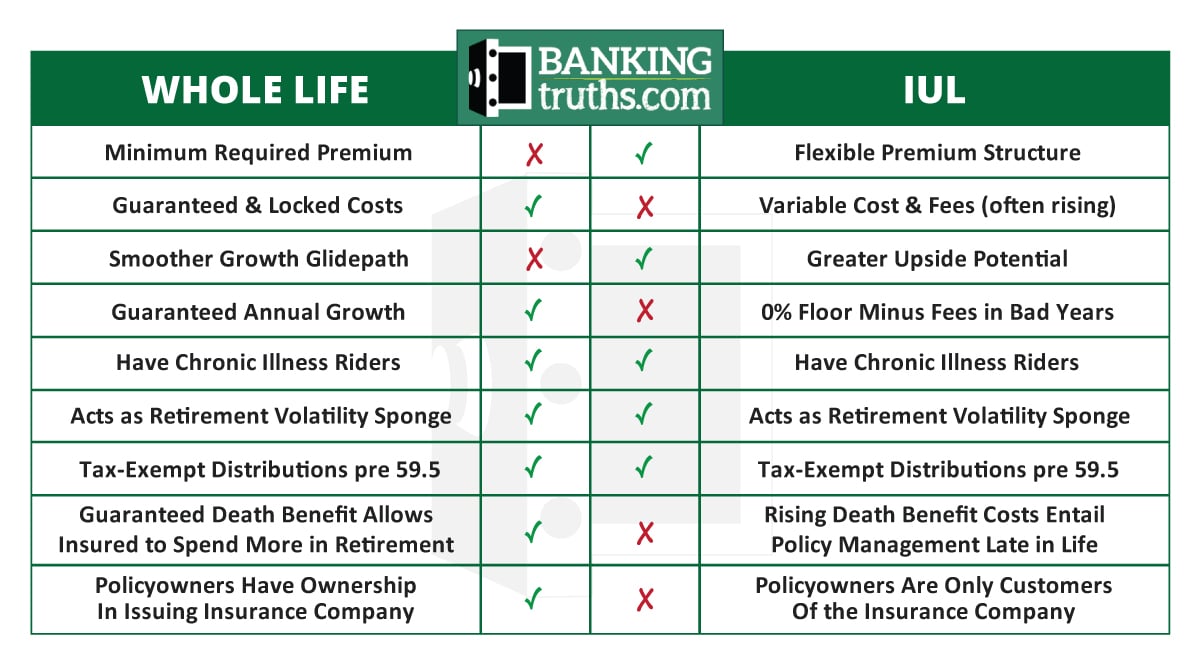

Universal Life Vs Whole Life Which Is Better

Decumulators can do it by withdrawing from asset courses that have succeeded. And naturally, nobody must be acquiring crammed mutual funds, ever before. Well, I hope posts like these assistance you to translucent the sales methods frequently used by "financial specialists." It's actually regrettable that IULs do not function.

Latest Posts

Universal Life Insurance Cash Value Calculator

Iul Vs 401k Calculator

Principal Group Universal Life